March 19, 2024

In this article, we share the results of this study, starting with insights on the increasing rotation in the CFO role and its impact on the business. We also explore what it takes to develop future CFOs as well as the future trajectory of current CFOs as they prepare for their next step. Finally, we provide some actions that CFOs as well as CEOs and chief human resources officers (CHROs) can take to adapt to shifts in tenure, responsibilities and characteristics of the modern CFO.

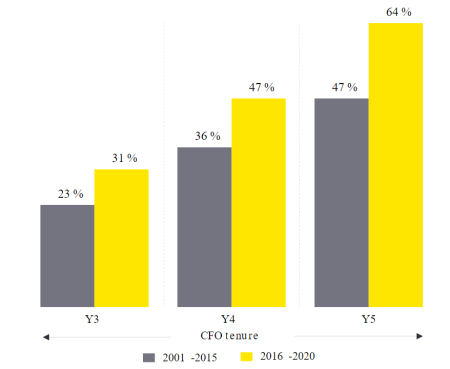

Analyzing a thousand executives who held the CFO role in a Fortune 250 company over the last 20 years, data shows that the velocity of CFO rotations continues to increase. Almost two-thirds (~64%) of Fortune 250 CFOs who were appointed to the role between 2016 and 2020 had exited by year five compared to only 47% of CFOs who were appointed between 2001 and 2015 with the same tenure. (Figure 1). The long-held custom of financial leaders being in their role for more than five years is tumbling, as almost half of CFOs now depart within the first four years.

Note: 1) Based on analysis of 567 CFOs appointed from 2001-2015 and 221 CFOs appointed from 2016-2020. For 2016-2020, CFOs whose tenure is greater than three years and are still serving in the role (e.g., appointed in 2020) were excluded from the analysis as departure year is not defined yet.

Source: EY Center for Executive Leadership analysis

As attrition rises, succession planning is becoming more important than ever, yet many organizations face these CFO transitions unprepared. Many appoint an interim CFO during a transition to bridge the gap until a full-time successor is found. In fact, the number of interim CFO hirings per year has almost doubled in the last decade in Fortune 250 CFO transitions, with less than a third of those interim CFOs moving into a permanent designation in the company. As a result, many of these companies end up managing two CFO transitions in less than a year, intensifying instability.

The combination of shorter tenures, higher attrition and an increase in the appointment of temporary CFOs is not a recipe for long-term success for any organization. For most, this churn may inhibit the stability required for growth and lead to lower total shareholder returns. Correlation does not imply causation, but organizations must consider the impact that shorter CFO tenures have on their strategic progress, operational execution and financial results. The data shows that longer-term CFOs (defined here as those that have been in their role for at least six years) have delivered average excess total shareholder return¹ (ETSR) that is 2.75 times higher than those CFOs with shorter tenures (in role for one to three years).

The trajectory of rising attrition and declining CFO tenure on organizations is further exacerbated by the increasing challenges associated with hiring or developing CFOs, which can be complicated and time-intensive due to the complexity of the evolving role.

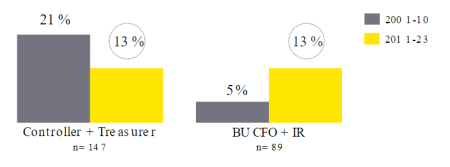

CFOs are no longer solely financial leaders and technical experts, but key business and operations leaders involved in far more complex and cross-functional projects, including business transformation, digital initiatives and addressing critical business challenges such as major market disruptions and investor activism. EY analysis of Fortune 250 CFOs shows a number of critical areas where CFOs are taking a broader, more involved leadership role:

Note:

1) Based on the analysis of ~900 individuals who held a CFO role between 2001-2023. The remaining 70%+ of CFOs not included in the chart come from other sources such as previous CFO role, Corporate Finance VP/SVP and other functional/leadership roles, and percentages for each of those sources have remained stable across the two periods.

Source: EY Center for Executive Leadership analysis

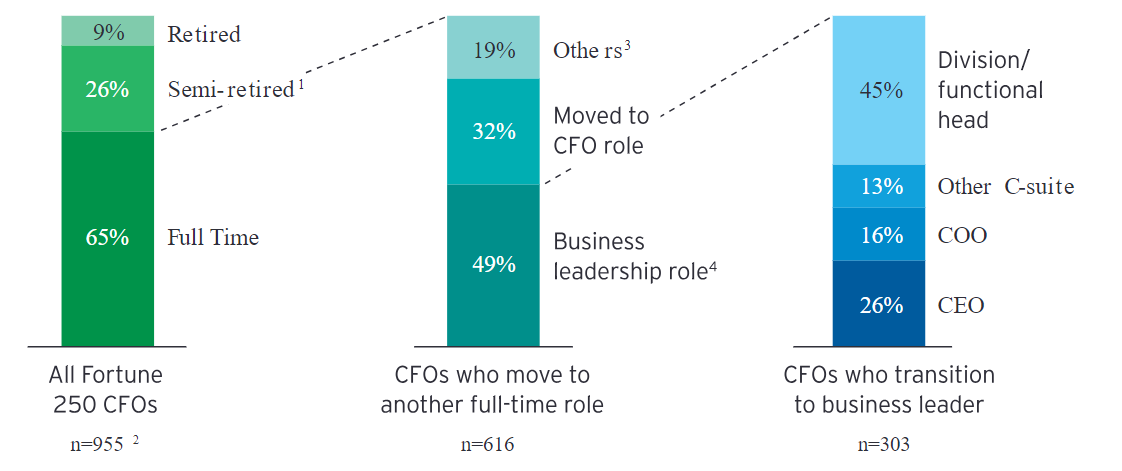

While ensuring succession planning and developing viable CFO candidates is critical, investing in the current CFO is paramount as companies may also be developing a future BU president, a chief operating officer (COO) or potentially even a CEO. Analysis of the path taken by all 1,000 executives who were CFOs of a Fortune 250 company in the last 20 years reveals that about two-thirds of CFOs – after their first CFO role – move into another full-time role while only 9% go into full-time retirement (the rest opting for semi-retirement as a board director or advisor.)

Of those who do continue full time:

Note:

1) Based on the analysis of 955 individuals who were Fortune 250 CFOs from 2000–2022.

2) Semiretired CFO roles include vice-chairman (VC)/chairman, advisor/consultant and board member.

3) Others include CFOs with roles like founder, senior executive, executive vice president (VP) and various positions.

4) Business leadership roles include CEO, COO, and other C-suite and divisional/functional heads who are heading a business unit/division, region or business function.

Source: EY Center for Executive Leadership analysis

As attrition continues to increase along with hiring challenges, it is now time for organizations to strategically prepare in two ways. First, make plans to develop the current CFOs for their expanded roles – both the current and potential future ones – and second, lay the appropriate groundwork for succession planning and processes to maintain a healthy future CFO candidate pipeline. Let’s take a more in-depth look at the actions each executive in the C-suite can take.

Most CFOs do not finish their career after their first CFO role. With a median age of just 48 at appointment and a median tenure of four years, these executives are often building experiences and reputations that take them into other C-suite roles, such as a business unit leader, CEO or the top finance position at other organizations. If you, as a CFO, are in this group, you may feel like the “next step” is not as clearly defined as the ones that brought you into the CFO role. Based on our experience working with seasoned CFOs, as well as interviewing CFOs as they transitioned to other executive roles, we have distilled insights that will help you reflect on how you want to shape the rest of your executive journey.

For what may be your last career transition, reflect on what you intend to achieve through the lens of your professional ambitions and personal considerations. Then, it is imperative to demonstrate your track record for that future role, enhance your personal brand and strengthen your network.

Here are five themes that we identified as common through our interviews and experiences with seasoned CFOs moving to their next role:

Given how prominent and impactful – as well as dynamic and complex – the role of the CFO is, CEOs and CHROs must devote significant time and thought to CFO career development and succession planning. This includes preparing the current CFO for success in their current role as well as potential trajectories for that executive in the future while also owning the development of future successors to the role. As CEOs and CHROs ready themselves for this critical effort, here are a few aspects they should consider:

Based on the increased rotation of CFOs as well as correlation with shareholder returns, investing in the current CFO – as well as their successors – should not only be a high priority but also a high-return investment of a CEO’s time.

As the CFO role continues to evolve during this age of transformation and disruption, it is critical that CFOs continue to broaden and round out their skill sets to not only satisfy the growing demands of their current role but also prepare themselves for their next career step, which may be outside of finance. For CEOs and CHROs, the priority is clear: invest now in developing your current CFO to better meet the needs of their complex role and, at the same time, begin succession planning for your organization’s next financial leader. Without being intentional about these efforts, organizations may find themselves seeking temporary solutions, which can destabilize the company and yield suboptimal business results.

|

Juan Uro EY Americas Leader, Center for Executive Leadership Experienced strategy, transaction and transformation advisor and operator. Board member. Husband, father of two. Juan, an EY-Parthenon Principal at Ernst & Young LLP, has over 20 years of industry and advisory experience, working with C-suite executives of Fortune 500 companies. He has developed deep skills in strategy, resource allocation, transactions and large-scale transformations. Prior to joining EY-Parthenon, Juan was an executive vice president for the NBA, having direct responsibility for the league’s finance and strategy functions. |

|

Samir Jaipati Samir is the EY Americas Finance Solution and Regional Go-to-Market Leader. In his role, Samir helps CFOs, finance and IT leaders reimagine the future of finance and develop strategic plans to enhance their digital capabilities. He helps finance leaders understand the impact of new technologies and explore opportunities to improve the performance of the finance function by leveraging people, organization and technology levers. Prior to joining EY, Samir spent 10 years with global consulting firms and 4 years in investment banking and corporate finance. He focuses on finance transformation, advising CFOs to resolve strategic issues in finance strategy, people, process and technology areas. Samir has over 25 years of professional experience in consulting, corporate finance and investment banking. He has an MBA from the Ross School of Business at the University of Michigan. |

Special contributions:

Amy Rahn, EY CFO Program Director

Eric Dore, EY CFO Program Director

Pat Grismer, EY CFO Advisor in Residence

Scott Galloway, EY CEL Program Director

Special thank you to Mukta Gupta and Gaurav Pandey for their diligent research and contributions to this article.

This article was originally posted on EY's Center for Executive Leadership. The Ignite blog is an official publication of the Kansas Society of CPAs, Copyright 2024.

THANK YOU TO OUR SPONSORS & PARTNERS IN ACCOUNTING EXCELLENCE!

|

|

|

|

Would you like to showcase your business by sponsoring the Ignite blog? Click here for more information.

© Copyright 2026 KSCPA | All Rights Reserved